About Us

Oxford Restructuring Advisors: Experts in business distress management

Say the word bankruptcy and the room goes quiet. People picture chaos, failure, the end of the line. But that’s not the story. Bankruptcy and the alternatives are built to restore order, protect stakeholders, and give companies a fair shot at resolution.

What Sets Us Apart

- National practice, Midwest base. We serve clients across the U.S., with deep roots in the Midwest.

- 25+ years of high-caliber experience. Expertise shaped at leading global restructuring and consulting firms.

- Lean, efficient model. Senior-led teams without unnecessary overhead or inflated fees.

- Nimble and responsive. The ability to move quickly and adapt in fast-changing environments.

- Collaboration with counsel. We complement legal strategy with financial and operational expertise, never duplicating effort.

Representative Matters

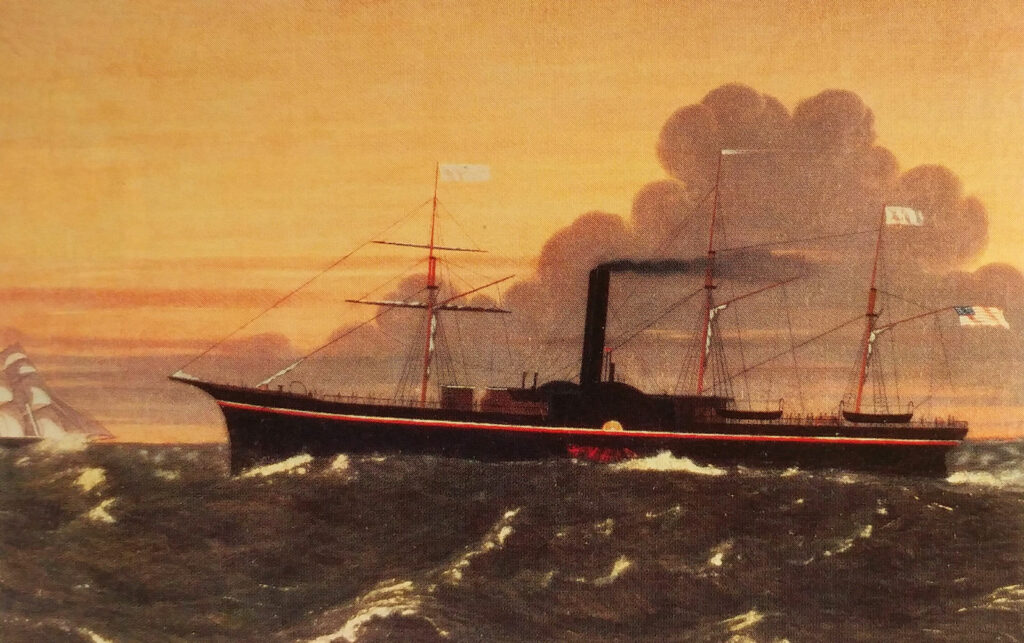

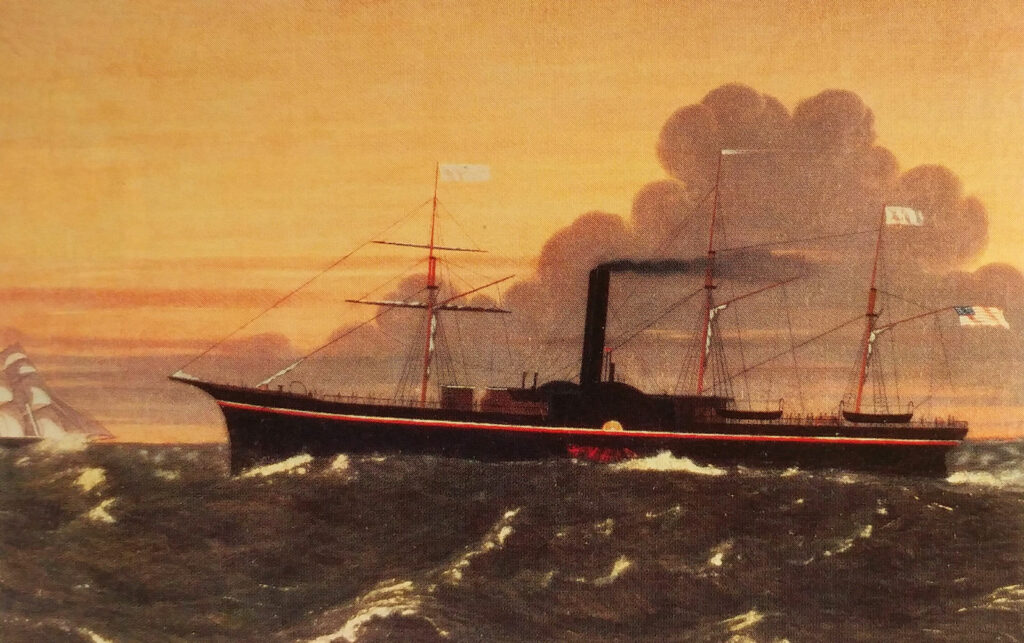

RLP (S.S. Central America)

Learn More

RLP (S.S. Central America)

Served as Trustee to Recovery Limited Partners, a private investment group engaged in salvaging the wreck of the S.S. Central America.

Amcast

Learn More

Amcast

Served as Financial Advisor to the liquidating trustee of Amcast, a metal products manufacturer.

InaCom Corp.

Learn More

InaCom Corp.

Served as Financial Advisor to the liquidating trustee of Inacom, an information technology products and services company.

Our Professionals

John Pidcock

Managing Director & Founder

John Pidcock has over twenty years of experience in the restructuring industry and has provided a full range of crisis management services to under-performing companies and their constituencies, including: interim management and debtor advisory; bankruptcy preparation and management; post-merger integration; debt restructuring and refinancing and post-confirmation creditor advisory. He has particularly deep expertise in performing post-confirmation debtor work and creditor committee representation.

Currently John is Trustee in AcuSport (SD of Ohio), Empire Die Cast (ND of Ohio) and Recovery Limited Partners (Franklin County Ohio). In addition, he is serving as Chief Restructuring Officer (“CRO”) for a $250 million revenue drug wholesaler managing its wind down and litigation process.

Prior to founding Oxford Restructuring Advisors, he was a Managing Director at Conway MacKenzie for 10 years. Before Conway, he was at Bridge Associates LLC for seven years and a manager at Deloitte Consulting for three years.

Recent work

Recently, he was CRO to a $75 million revenue consumer products manufacturer and managed its refinance process and balance sheet restructuring. Additional recent engagements include advisory work to companies in automotive (privately held green energy supplier), building products (middle market concrete provider), protein (pork provider) and metals industries (die cast company), among others.

$50 million Consumer Products Company – Financial Advisor and Chief Restructuring Officer

$75 million Consumer Products Manufacturer – Financial Advisor and Chief Restructuring Officer

Nationally Recognized Restaurant Group – Financial Advisor

US Concrete – Financial Advisor to the Official Committee of Unsecured Creditors

Empire Die Cast Company – Post-confirmation Trustee

Arch Aluminum & Glass Company – Post-confirmation Trustee

Infotelecom Company – Post-confirmation Trustee

Andy Simon is an experienced restructuring advisor who has been consulting troubled companies and their stakeholders for nearly 20 years. He has practiced both as an attorney and as a certified public accountant in bankruptcy cases and other insolvency proceedings for debtors and creditors. Andy has particular experience representing buyers and sellers of distressed assets as well as troubled companies, lenders, indenture trustees and creditor groups in both Section 363 transactions and out-of-court asset sales.

Prior Before joining Oxford, Andy was a practicing attorney at Squire Patton Boggs and Calfee, Halter & Griswold for 12 years. Before his law career, he was an advisor at a boutique investment bank focused on troubled companies and their creditor groups, primarily in complex chapter 11 bankruptcy cases. He has also practiced as a certified public accountant and worked in the transactions advisory services group of a Big 4 accounting firm, advising on cash flow M&A due diligence and cash flow analyses.

Recent work

Andy recently represented a secured lender group in the successful appointment of a receiver for the repayment of a healthcare group’s $75 million loan.

$2 billion+ Oil and Gas Producer – Advisor to the Official Committee of Unsecured Creditors

$100 million Nursing Home Management Company – Advisor to the Senior Secured Lender Group

Flat Out Crazy LLC (Flat Top Grill & Stir Crazy restaurant group) – Chapter 11 Advisor to the Debtors in Possession

Andrew M. Simon

Managing Director

Houston Lichtefeld

Senior Associate

Michael Fleischer

Associate

Oakley Tippen

Analyst

Adam Takas

Analyst

Michael Fleischer

Associate

Michael Fleischer is an experienced restructuring associate who brings over 3 years of financial advisory experience. Building off his prior experience as an investment banker, Mr. Fleischer particularly focuses on valuation, financial modeling, and other financial analyses for distressed companies.

At Oxford, Mr. Fleischer is a key part of Chapter 11 debtor and creditor advisory, assignments for the benefit of creditors, insolvency analyses, expert witness engagements, and wind-downs.

Oakley Tippen

Analyst

Since joining the firm, Oakley has contributed to engagements in various industries, including construction, technology, healthcare, restaurant services, and automotive, utilizing his financial and analytical skills to help clients navigate complex restructuring challenges. Oakley joined Oxford Restructuring Advisors in July 2024 after earning a Bachelor of Business Administration degree with a Specialization in Finance from The Ohio State University’s Fisher College of Business.

Adam Takas

Analyst

Since joining Oxford in June, 2025, Adam has contributed to complex restructuring cases across healthcare, construction, energy, and technology sectors. Prior to being at Oxford, he has two years of experience with UBS wealth management while he earned his Bachelors of Science in Finance and Real Estate from the University of South Carolina’s Darla Moore School of Business. At Oxford, he is dedicated to delivering tailored solutions that help clients navigate complex restructuring challenges.

Houston Lichtefeld

Senior Associate

As a CPA, CFE, and CIRA candidate, Houston has nearly four years of experience advising debtors and creditors across industries including manufacturing, farming, health products, energy, construction and real estate. Previously with PwC’s Cincinnati office, he supported multi-billion-dollar clients in audit, valuation, and insolvency risk analysis. Houston earned bachelor’s in accounting and finance and a master’s in accounting from the University of Kentucky, graduating summa cum laude. He brings a wide range of skills applicable to restructuring, creditor advisory, insider investigations, and financial reporting in special situations.

How to Engage

Here’s how we work together.

Talk with Us

Start with a focused conversation about your case and your role.

See the Options

We’ll outline strategies and tradeoffs

for each.

Move forward

Oxford steps in at the right level to execute the plan alongside counsel.